[Planificación De Seguros: Duración Y Cobertura]

Executive Summary

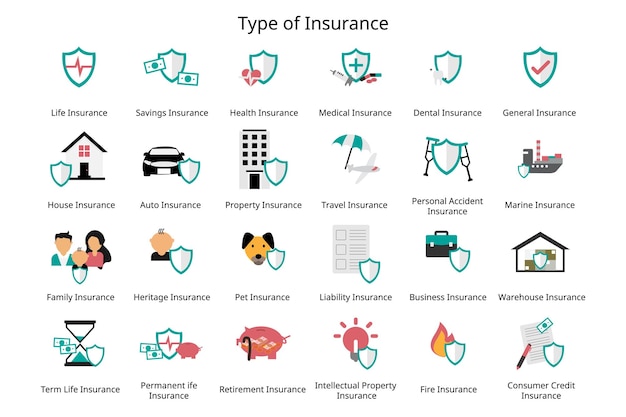

Choosing the right insurance plan is a crucial financial decision, impacting your security and peace of mind for years to come. This comprehensive guide delves into the intricate world of insurance planning, focusing on the critical aspects of policy duration and coverage. We’ll explore various insurance types, helping you understand how to optimize your protection based on your specific needs and financial situation. Navigating insurance can feel overwhelming, but with careful planning and a clear understanding of your options, you can confidently secure your future. This guide aims to equip you with the knowledge to make informed decisions, ensuring your insurance plan aligns perfectly with your long-term goals.

Introduction

Insurance is more than just a financial product; it’s a safety net, a promise of protection against unforeseen circumstances. Choosing the right insurance plan, however, requires careful consideration of various factors, primarily the duration of your coverage and the extent of the coverage itself. This guide will help you navigate this complex process, empowering you to select a plan that provides optimal protection without unnecessary expenses. We will explore key aspects influencing your insurance choices, including policy terms, coverage limits, and the impact of personal circumstances on your insurance needs. Understanding these elements is critical to making smart, cost-effective insurance decisions.

FAQ

Q: How long should my insurance policy last? A: The optimal duration depends heavily on your specific needs and the type of insurance. Home and auto insurance policies are often annual, while life insurance policies can span decades, sometimes even being whole-life policies. Consider your risk tolerance and financial goals when determining the length of your policy.

Q: What factors determine insurance coverage? A: Coverage is determined by several factors including the type of policy, your risk profile (age, health, location), and the specific coverage options you select. Higher coverage typically comes with higher premiums. It’s crucial to assess your potential risks and choose a coverage level that adequately addresses them.

Q: Can I change my insurance coverage mid-term? A: Generally, you can modify your coverage, but there might be limitations and potential penalties depending on the insurer and the type of insurance. Contact your insurer to understand the specific terms and conditions regarding modifications to your existing policy.

Tipos de Seguros y Duración de la Cobertura

Understanding the different types of insurance and their typical coverage durations is crucial for effective planning. Each type has specific requirements and implications for your overall financial strategy.

- Comprehensive Coverage: This offers extensive protection against a wide range of risks, usually at a higher premium.

- Term Length: Policies can vary from one year to a lifetime, depending on your needs and the insurer’s offerings.

- Renewal Options: Understand your options for renewing your policy at the end of its term, including potential changes in premiums.

- Customization: Many policies offer customizable features, allowing you to tailor your coverage to your precise needs.

- Claim Process: Familiarize yourself with the claim process to ensure a smooth experience when you need to use your insurance.

- Policy Exclusions: Understand the specific risks that are not covered by your policy.

Factores Que Influyen en la Cobertura

Several factors significantly influence the extent of your insurance coverage and the premium you pay. Understanding these factors allows you to make informed decisions that suit your unique situation.

- Risk Assessment: Insurers carefully assess your risk profile to determine appropriate coverage levels and premiums. This often involves a detailed application process.

- Coverage Limits: Understand the maximum amount your insurer will pay out for a particular claim. Choosing higher limits provides greater protection, but at a higher cost.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles lead to lower premiums, but also to higher upfront costs in case of a claim.

- Premium Payments: Insurance premiums are the payments you make to maintain your coverage. Frequency of payments varies (annual, semi-annual, quarterly, or monthly).

- Policy Exclusions: Pay close attention to the specific circumstances and events that are explicitly excluded from your coverage.

- Add-ons and Riders: Many insurers offer optional add-ons and riders which can enhance your coverage but will increase premiums.

Comparación de Proveedores de Seguros

Comparing different insurance providers is crucial to finding the best value and coverage for your needs. Don’t rely solely on price; compare the scope of coverage, terms, and customer service.

- Online Comparison Tools: Use online comparison websites to quickly evaluate different insurance providers and their offerings.

- Customer Reviews: Read online reviews and testimonials to gauge the experiences of other customers with different insurance companies.

- Policy Documentation: Carefully examine the policy documents of different providers before committing to any particular plan.

- Financial Stability: Assess the financial stability of potential insurers to ensure they can meet their obligations if you need to file a claim.

- Customer Service: Consider the quality of customer service offered by the insurance provider, as you may need to contact them during a claim.

- Claim Process Transparency: Understand the claim process outlined by different insurance providers and choose one with a clear and transparent process.

Consejos para una Planificación Efectiva de Seguros

Effective insurance planning requires a proactive approach. By following these tips, you can enhance your protection and ensure financial security.

- Regular Review: Regularly review your insurance coverage to ensure it still meets your current needs and circumstances. Your needs may change over time, requiring adjustments to your coverage.

- Professional Advice: Consult with a qualified insurance advisor who can assist you in making informed choices based on your circumstances.

- Financial Planning Integration: Integrate insurance planning into your broader financial strategy to optimize resource allocation and ensure comprehensive protection.

- Emergency Fund: Establish a dedicated emergency fund that can cover unexpected costs before utilizing your insurance coverage.

- Understanding Policy Language: Don’t hesitate to seek clarification if you don’t fully understand the terms and conditions of your insurance policy.

- Accurate Information: Provide accurate and complete information during the application process to avoid any issues with your coverage.

Conclusion

Planning your insurance effectively is a continuous process that requires careful consideration of your needs, financial capabilities, and future goals. By understanding the nuances of policy duration, coverage limits, and the various factors that influence your premiums, you can make informed decisions to secure your financial well-being. Remember, insurance is not just about mitigating risks; it’s about achieving peace of mind, allowing you to focus on your personal and professional endeavors without the constant worry of unforeseen events. Taking the time to thoroughly research, compare, and understand your options empowers you to choose the best insurance protection for your specific circumstances, providing a vital layer of security for your future.

Keyword Tags

[Seguro de vida], [Cobertura de seguro], [Planificación financiera], [Duración del seguro], [Comparación de seguros]