[Plata Como Inversión: ¿Buena Opción O No?]

Executive Summary

Investing in precious metals, specifically silver (plata), has long been a topic of debate among investors. While not as volatile as some stocks or cryptocurrencies, it presents its own set of challenges and rewards. This comprehensive guide delves into the complexities of silver as an investment, exploring its potential benefits and drawbacks, helping you decide if it aligns with your financial goals and risk tolerance. We’ll examine various aspects, from understanding market dynamics to considering different investment vehicles, equipping you with the knowledge to make informed decisions. Ultimately, whether silver is a “good option” for you depends on your individual circumstances and investment strategy.

Introduction

The allure of precious metals as a safe haven asset is undeniable. Among them, silver often takes a backseat to gold, yet it holds unique characteristics that merit consideration. This article provides a detailed exploration of silver as an investment, examining its historical performance, current market trends, and various investment avenues available to both seasoned investors and newcomers. We aim to demystify the process, equipping you with the knowledge needed to assess if silver investment fits within your broader financial portfolio. Whether you are seeking diversification, inflation hedging, or simply exploring alternative investment opportunities, understanding the nuances of silver is crucial.

Preguntas Frecuentes (FAQ)

¿Es la plata una inversión segura? No existe una inversión completamente segura. La plata, al igual que cualquier otro activo, está sujeta a fluctuaciones de precio. Sin embargo, históricamente ha demostrado ser un activo relativamente estable a largo plazo y un buen activo de refugio durante tiempos de incertidumbre económica.

¿Cómo puedo invertir en plata? Puedes invertir en plata de diversas maneras, incluyendo la compra de lingotes o monedas de plata físicas, ETFs (Exchange Traded Funds) de plata, o acciones de empresas mineras de plata. Cada método tiene sus ventajas y desventajas en términos de costos, almacenamiento, y liquidez.

¿Cuál es el mejor momento para invertir en plata? No hay un momento perfecto para invertir en ningún activo, incluyendo la plata. El momento ideal depende de tu estrategia de inversión, tolerancia al riesgo y horizonte temporal. El análisis fundamental y técnico pueden ayudarte a identificar posibles oportunidades de entrada y salida, pero recuerda que estas son solo predicciones y no garantías de éxito.

El Mercado de la Plata: Dinámica y Tendencias

The silver market is influenced by a complex interplay of factors, including industrial demand, investment demand, and geopolitical events. Understanding these dynamics is crucial for navigating the market effectively.

Industrial Demand: Silver’s industrial applications are vast, ranging from electronics and solar energy to medical devices and photography. Strong industrial growth typically boosts silver demand, driving price increases. However, technological advancements can also impact demand.

Investment Demand: Investor sentiment significantly influences silver prices. During times of economic uncertainty or inflation, investors often flock to precious metals as a safe haven, increasing demand and pushing prices higher. Conversely, a shift in investor sentiment can lead to price declines.

Geopolitical Factors: Geopolitical instability, trade wars, or sanctions can create uncertainty in global markets, impacting the price of silver. Events affecting major silver-producing countries can also influence supply and demand.

Precio del Oro: The price of gold often has a significant correlation with the price of silver. When gold prices rise, silver prices tend to follow, and vice versa. This correlation isn’t always perfect, but it’s an important factor to consider.

Oferta y Demanda: The fundamental principle of supply and demand dictates the price of silver. A shortage of silver due to reduced mining output or increased demand can lead to higher prices, while an oversupply can depress prices.

Especulación: Speculative trading can significantly impact silver prices in both the short and long term. Large financial institutions and individual traders can drive price volatility through buying and selling activities.

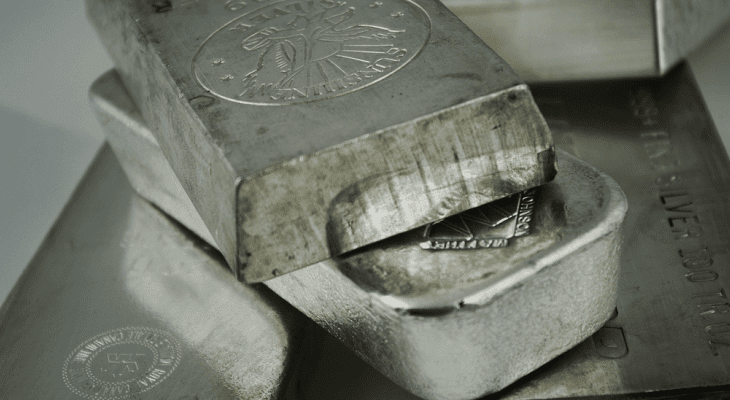

Invertir en Plata Física: Lingotes y Monedas

Investing in physical silver, such as bars or coins, offers a tangible asset that you can own and control. This method provides a certain level of security and avoids counterparty risk associated with other investment vehicles.

Almacenamiento: Secure storage is crucial when investing in physical silver. Consider using a safe, safety deposit box, or a specialized storage facility. The cost of storage should be factored into your overall investment strategy.

Pureza: Ensure the silver you purchase is of high purity (e.g., .999 fine silver). The purity is usually indicated on the bar or coin. Lower purity means lower value.

Prima: Be aware that the price you pay for physical silver will typically include a premium over the spot price. This premium covers the costs of manufacturing, refining, and distribution.

Liquidez: While physical silver is generally considered a liquid asset, selling it might not be as instantaneous as selling stocks or ETFs. You’ll need to find a buyer, whether a precious metals dealer or a private individual.

Costo: Factor in all the costs of purchasing and storing the physical silver. The premiums, insurance, and storage fees can add up. This is particularly important for large-scale investments.

Riesgos: Physical silver investments are exposed to risks like theft and damage. This necessitates secure storage practices and potentially insurance policies.

ETFs de Plata: Diversificación y Accesibilidad

Exchange-Traded Funds (ETFs) that track silver prices offer a convenient and cost-effective way to gain exposure to the silver market. They combine the benefits of diversification and ease of trading.

Diversificación: Investing in a silver ETF provides instant diversification across multiple silver producers and markets. This reduces the risk associated with relying on a single company or mine.

Liquidez: ETFs trade on major stock exchanges, offering high liquidity. This makes it easy to buy and sell your investment quickly.

Costos: ETFs have lower costs compared to actively managed funds that invest in precious metals.

Comisiones: Brokers charge commissions for buying and selling ETFs. These fees should be compared across platforms to find the best deal.

Gastos: ETFs typically have an expense ratio which represents an annual management fee. This should be factored into your overall return calculations.

Información: ETFs are transparent, with detailed information readily available on their holdings and performance. This is vital for due diligence and tracking investment performance.

Acciones de Empresas Mineras de Plata: Crecimiento y Riesgo

Investing in shares of silver mining companies provides exposure to the silver market while also offering the potential for higher returns if the company performs well. However, this approach involves a higher level of risk compared to ETFs or physical silver.

Riesgo empresarial: Mining companies face operational risks such as production disruptions, accidents, and cost overruns. This can impact profitability and share prices.

Precio de la plata: The profitability of silver mining companies is directly tied to the price of silver. A decline in silver prices will likely negatively impact share prices.

Volatilidad: Shares of mining companies can be quite volatile, making them suitable for investors with a higher risk tolerance.

Crecimiento: Well-managed mining companies can offer high growth potential, particularly during periods of strong silver demand.

Análisis Fundamental: Thorough fundamental analysis is crucial when selecting silver mining companies for investment. Pay attention to their financial statements, production capabilities, and management team.

Diversificación: Diversification across multiple mining companies is vital to mitigate risk associated with investing in a single entity.

Contratos de Futuros de Plata: Apalancamiento y Riesgo Elevado

Silver futures contracts are derivative instruments that allow investors to speculate on the future price of silver. These instruments offer leverage, but they also carry significant risk. Futures contracts are primarily for sophisticated investors with a strong understanding of financial markets.

Apalancamiento: Futures contracts allow investors to control a significant amount of silver with a relatively small investment. This magnifies both potential profits and losses.

Margen: Investors need to maintain a margin account to cover potential losses. If the market moves against them, they might receive margin calls requiring additional funds.

Riesgo de mercado: Futures contracts are extremely volatile and susceptible to market fluctuations. Significant losses can occur quickly.

Estrategia: A well-defined trading strategy is essential when using futures contracts. Without a clear plan, losses can accumulate rapidly.

Conocimiento del mercado: Thorough understanding of the silver market, technical analysis, and risk management techniques are crucial for success.

Liquidez: Silver futures contracts are highly liquid, allowing investors to exit their positions relatively easily.

Conclusión

Investing in silver offers a multifaceted approach to portfolio diversification. Whether you opt for the tangible security of physical silver, the ease of ETFs, the growth potential of mining stocks, or the leverage of futures contracts, a thorough understanding of the market dynamics, risks, and individual investment goals is paramount. Remember that no investment guarantees a profit, and silver, like all assets, is subject to market fluctuations. Diligent research, risk assessment, and a long-term perspective are key to successfully navigating the silver investment landscape. This article serves as a starting point for your journey, empowering you to make well-informed choices that align with your financial aspirations. Remember to seek professional financial advice before making any investment decisions.

Keyword Tags

Plata, Inversión en Plata, ETFs de Plata, Acciones Mineras Plata, Mercado de la Plata