All about Taxation and Tax Saving Schemes in India

“The hardest thing to understand in the world is Income Tax”

By Albert Einstein

Let’s understand the basics of taxation and best tax saving schemes available in India. So we shall begin this article with what is income tax.

Income tax is a tax that is levied by the central government on the income earned by the individual and businesses during a financial year. The revenue generated from tax is used in the infrastructure development, health care facilities, subsidy to farmers and agricultural sector, education and other welfare schemes of the government. The calculation of tax to be paid by an individual or business is based on the income slab rate applicable during the financial year.

Tax Rates in India

Mentioned below are tax rates applicable to an individual who is a resident but not ordinarily a resident or NRI who is of less than 60 years of age and HUF:

| Total Income | Old tax regime (with deductions and exemptions) | New tax regime ( without deductions and exemptions) |

| Upto 2.5 lakhs | NIL | NIL |

| 2.5 TO 5 Lakhs | 5% | 5% |

| 5 to 7.5 | 20% | 10% |

| 7.5 to 10 | 20% | 15% |

| 10 to 12.5 | 30% | 20% |

| 12.5 to 15 | 30% | 25% |

| Above 15 | 30% | 30% |

A tax payer has the option to select the new regime or the old regime of tax. To pay tax under new regime the individual has to forego the exemptions and deductions available under income tax. But if he pays tax under the old regime, he can avail the rebates and exemptions.

For a resident Indian of age above 60 years to 80 years they are eligible for the same rates as mentioned above except for these additions:

| Total Income | Old tax regime (with deductions and exemptions) | New tax regime ( without deductions and exemptions) |

| 2.5 to 3 lakhs | NIL | NIL |

| 3 to 5 lakhs | 5% | 5% |

- Surcharge:- Apart from income tax, surcharge is levied on the amount of the income tax of the assesse if his total income exceeds the following limits:

| Income range | 50 lakhs to 1 Cr | 1 Cr to 2 Cr | 2 Cr to 5 Cr | 5 Cr to 10 Cr | Above 10 Cr |

| Rate of Surcharge | 10% | 15% | 25% | 37% | 37% |

The additional surcharge of 25 % and 37% is not levied on the income chargeable to tax under section 111A, 112A and 115AD.

- Health and education cess:- 4% health and education cess is levied on the amount of income tax.

- Rebate:- A resident individual whose income does not exceed 5 lakhs can avail the benefit of rebate u/s 87A. It is deducted from income tax before calculating the education. The amount is rebate is 12,500 or 100% whichever is less.

Also Read: Classification of Banking System in India and how does it work with RBI?

Tax on Equity and Debt Funds

Equity funds

Equity funds invest in the stocks of the company. Thus, the performance of the company plays a major role in deciding the returns an individual gets. Equity funds gives higher returns but also involves higher risk due to the volatility of the markets. Investment in equity fund is suitable for investors who wants to invest for longer duration as it bears good returns when held over a prolonged period.

Tax on Equity Funds

Tax levied on equity funds are of two types depending upon the duration for which they are held – Long Term Capital Gain Tax (LTCG) and Short Term Capital Gain Tax (STCG).

Long term capital gain tax is levied on equity funds that are held for more than 1 year. The current LTCG tax is 10% without indexation. Gains upto 1 lakh are exempt from taxation. Indexation is the process of adjusting the purchase cost against inflation.

Equity funds held for less than a year are charged under short term capital gain tax. The revised rate for tax under STCG is 15%.

Debt Funds

Debt funds invest their capital in securities like debentures, corporate bonds, government securities, etc. These funds hold less risk as their returns are not depended on the volatility of the markets. Debt funds are suitable for investors who are looking for moderate to low risk and duration of short to medium term.

Tax on Debt funds

Two types of taxes are levied on debt funds namely Long Term Capital Gain (LTCG) and Short Term Capital Gain Tax (STCG)

- Long Term Capital Gain Tax (LTCG)

Long Term Capital Gain (LTCG) is levied on debt funds that are held for more than 3 years. The current tax rate for LTCG on debt funds is 20% with indexation.

- Short Term Capital Gain Tax (STCG)

Short Term Capital Gain tax is levied on debt funds that are held for less than 3 years. It is calculated as per the individual’s tax slab rate.

For e.g. If the tax rate applicable to an investor is 20% then he will be liable to pay 20% tax for his STCG.

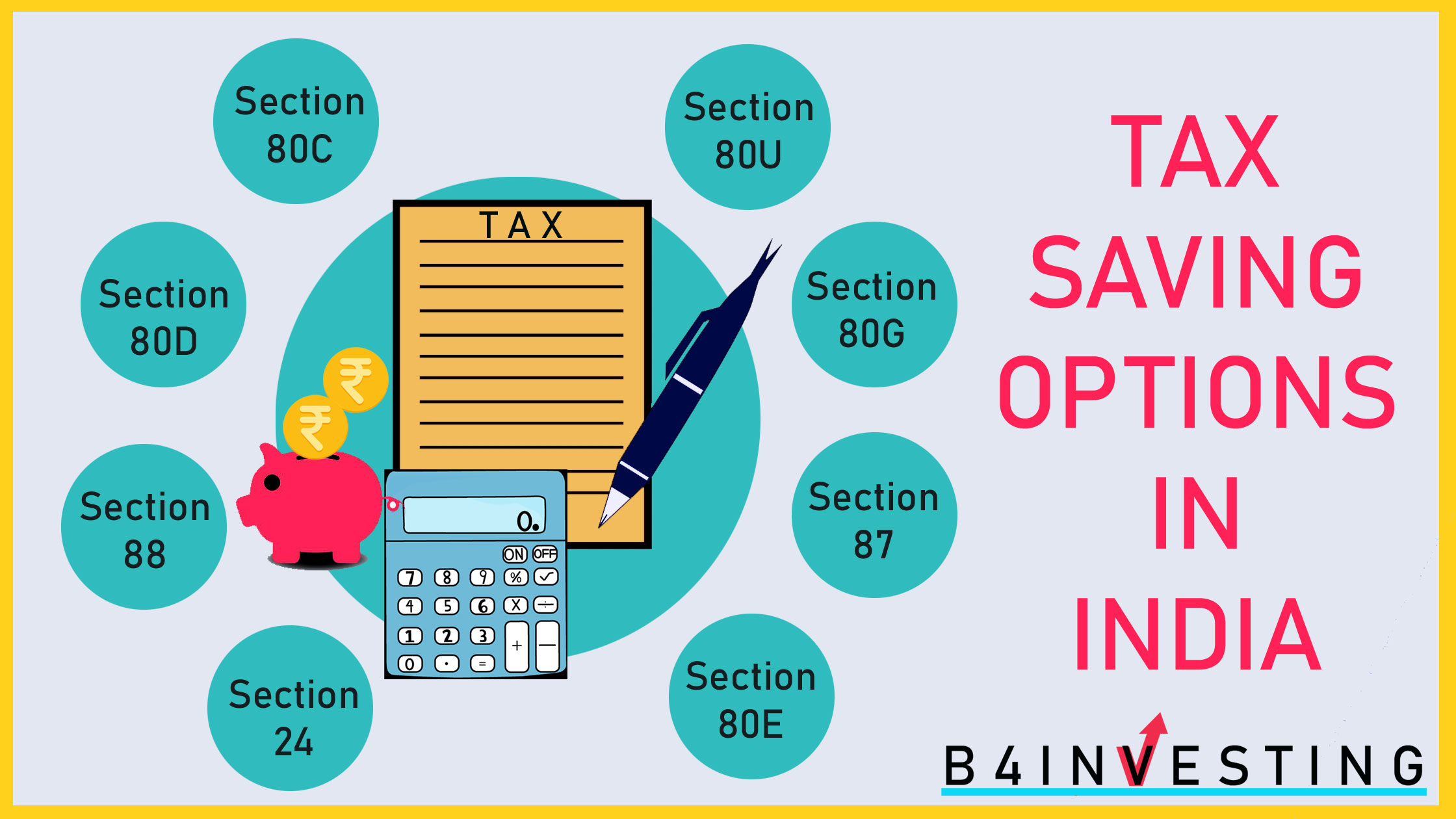

Tax Saving Schemes in India

“A penny saved is a penny earned”. With proper tax planning you can save on your taxes and increase your income. The income tax act provides exemptions and deduction for various investments and savings made by a taxpayer during the financial year. We shall take a brief view of the most popular tax saving schemes available to individuals and HUF under section 80C, 80D and 80EE.

| Investment | Description | Returns (interest) | Lock in period |

| 5- year Bank Deposit | A tax saver FD is a deposit scheme where you can avail tax deduction on investment amount of Rs. 1.5 lakhs. However, the interest earned on such deposits are taxable. | 5% to 7% | 5 years |

| Public Provident Fund (PPF) | PPF is ideal investment for those who have low risk appetite. As it is mandated by the government, the returns are guaranteed. It’s a long term investment. | 7% to 8% | 15 years |

| National Saving Certificate | National saving certificate is a saving scheme with any post office for small and mid- income investors. They are meant only for individual investors and not HUF, trust or organisations. | 7% to 8% | 5 years |

| National Pension System (NPS) | NPS is a pension plan launched by the government. Any individual between 18 to 60 years are eligible for NPS. It is not market linked, thus have stable returns. Its aims is mainly to build a retirement corpus for an individual. | 12% to 14% | Till Retirement |

| ELSS Funds | Equity linked saving schemes have dual benefits such as tax deduction and wealth accumulation. The lock in period of 3 years is the shortest among all tax saving investment options. Moreover, they offer highest returns among all. | 15% to 18% | 3 years |

| Unit Linked Insurance Plan (ULIP) | Investing in a ULIP policy you entire premium can be deducted from your taxable income upto a limit of 1.5 lakhs. The payout on its maturity is also not taxable under sec 10(10D). | Varies with the selected plan | 5 years |

| Sukanya Samridhi Yojna(SSY) | Sukanya Samridhi is a government launched scheme to benefit the girl child. A girl child of age 10 or less can avail benefits under this scheme. | 7.6% | NA |

| Senior Citizens Saving Scheme (SCSS) | SCSS is one of the post office saving scheme backed by the government for retirement benefits for senior citizens. Senior citizens can invest a lumpsum and get a regular cash inflow along with tax benefits. | 7.40% | 5 years |

Apart from the above tax saving investment options there are other deductions that fall under the category of sec 80 such as:

- Mediclaim of insurance premium claimed upto 50,000

- Interest on home loan upto 2 lakhs u/s 80EE

- Charity to notified institutions u/s 80G

- Interest paid on education u/s80E

| Section 80C |

| Employee Provident Fund (EPF) Public Provident Fund (PPF) Equity Linked Saving Schemes (ELSS) National Pension Scheme (NPS) Life Insurance Premium National Saving Certificate (NSC) Tax Saving FD Senior Citizen Saving Scheme Sukanya Samriddhi Yojna Unit Linked Insurance Plan (ULIP) Principal Payment of Home Loan |

| Section 80GGA |

| Donation to Scientific Research |

| Section 80CCD(1B) |

| National Pension Scheme (NPS) |

| Section 80D |

| Medical Insurance 25000 below 60 years age 50000 above 60 years age |

| Section 80DDB |

| Treatment of serious disease 100000 for senior citizen 40000 for others |

| Section 80E |

| Payment of interest on Education Loan |

| Section 80G |

| Donation to Charitable Trust |

| Section 80GGA |

| Donation to Scientific Research |

| Section 80GG |

| House Rent if HRA not part of salary |

| Section 80GGC |

| Donation to Political Parties |

| Section 87A |

| Tax Rebate upto 12500 if income does not exceed 500000 |

| Section 80TTA |

| Interest earned on Saving A/c up to 10000 |

| Section 88TTB |

| Interest earned on Saving A/c up to 50000 for senior citizen |

| Section 24 |

| Payment of interest on home loan up to 200000 |

Also Read: 17 Types of Credit Cards, Pros & Cons of Credit Card

Take away

We read how to save tax by choosing the right investment option. The best time to do your tax planning is the beginning of the financial year. Most investor procrastinate till the end and take hurried decision. If you start from the beginning it will help you compound your wealth and achieve your long term goals. One more thing to remember tax planning is an additional perk and not a goal in itself.

FAQ

Is the interest received on the tax saving FD taxable?

Yes, the interest received on a tax saving FD is taxable.

Can I save tax on an education loan?

Yes, section 80E of the I-T Act allows an individual to claim the entire interest paid on an education loan. An individual can claim as a deduction from gross total income before calculation of taxable income.

Can deduction on premium paid for parents health insurance be taken?

Yes, you can take deduction on premium paid for parents health insurance. If your parents are aged below 60 years then a maximum of Rs. 25,000 and for age above 60 years maximum of Rs. 30,000 can be claimed as deduction.

Should I invest in PPF for saving tax?

Yes, you can definitely save tax by investing in Public Provident Fund (PPF). It purely depends on your age. If you are in the age bracket of 18 – 50, ideally you should invest in Equity Linked Saving Schemes (ELSS) as returns are better in long term. For people who are happy with lower but a secured return and who do not want volatility can go with PPF.