CLASSIFICATION OF MUTUAL FUNDS

Mutual funds: According to the Association of Mutual Funds in India(AMFI), mutual fund is a pool of money managed by a trust that collects money from a number of investors sharing similar investment objectives and invests the same in equities, bonds, money market instruments, and/or other securities.

Mutual funds are the most conducive option for an amateur investor, who neither has any idea about the stock markets nor has the time to research the markets and make investment decisions. These funds are managed by professional fund managers who are experts in this field and do all the ground work for the investor and invest in different portfolios, in line with the scheme’s stated objective. The investor needs to just choose the type of fund that he would like to invest in and leave the rest to the fund managers. In return, the investors are charged a small fee by the fund house, which is deducted from the investment. The fees charged by mutual fund houses are regulated and are subject to certain limits specified by the Securities and Exchange Board of India (SEBI).

Like all other investments, mutual funds carry their share of risks too. Hence, the investor has to compare the risks and expected returns after tax deductions on various instruments when taking investment decisions.

Also Read: Taxation and Tax Saving Options in India

What are the benefits of mutual funds?

1. Saves time and energy:

“Mutual funds were created to make investing easy, so consumers wouldn’t have to be burdened with picking individual stocks.” states Mr. Scott D. Cook, the Director of eBay and Procter & Gamble.

Mutual funds are managed by professional fund managers for a fee and as quoted above, they are created to make investment easy and hence save time and energy that goes into researching the markets. They are a very suitable option for a newbie investor.

2. Less risky: Mutual funds are less risky compared to shares because they invest in a diversified portfolio. For eg., if the share price of one of the company’s in the portfolio goes down and the share price of another company in the same portfolio goes up, the NAV would average out and the exposure to risk will be less.

3. Provide an array of options: There are a wide variety of schemes one can choose depending upon their financial goals and risk tolerance. There are pure equity funds or hybrid funds which have a mix of equity, debt and other money market instruments.

4. Liquidity: Open-ended funds offer great flexibility and the investor can redeem the units at any point in time.

5. Smaller amounts can be invested: Even a small amount can be invested depending upon one’s financial position. Mutual funds offer SIPs (Systematic Investment Plan) where one can invest a fixed amount as small as Rs. 250/- monthly or quarterly – similar to that of recurring deposits in banks.

Also Read: SHARES OR MUTUAL FUNDS? WHICH IS A BETTER INVESTMENT VEHICLE FOR COMMON PEOPLE?

Types of Mutual Funds | Mutual Fund Classification

Mutual funds offer a diverse choice of investment options. The investor can choose a suitable option depending on the risk appetite, duration of investment, individual financial goals, etc.

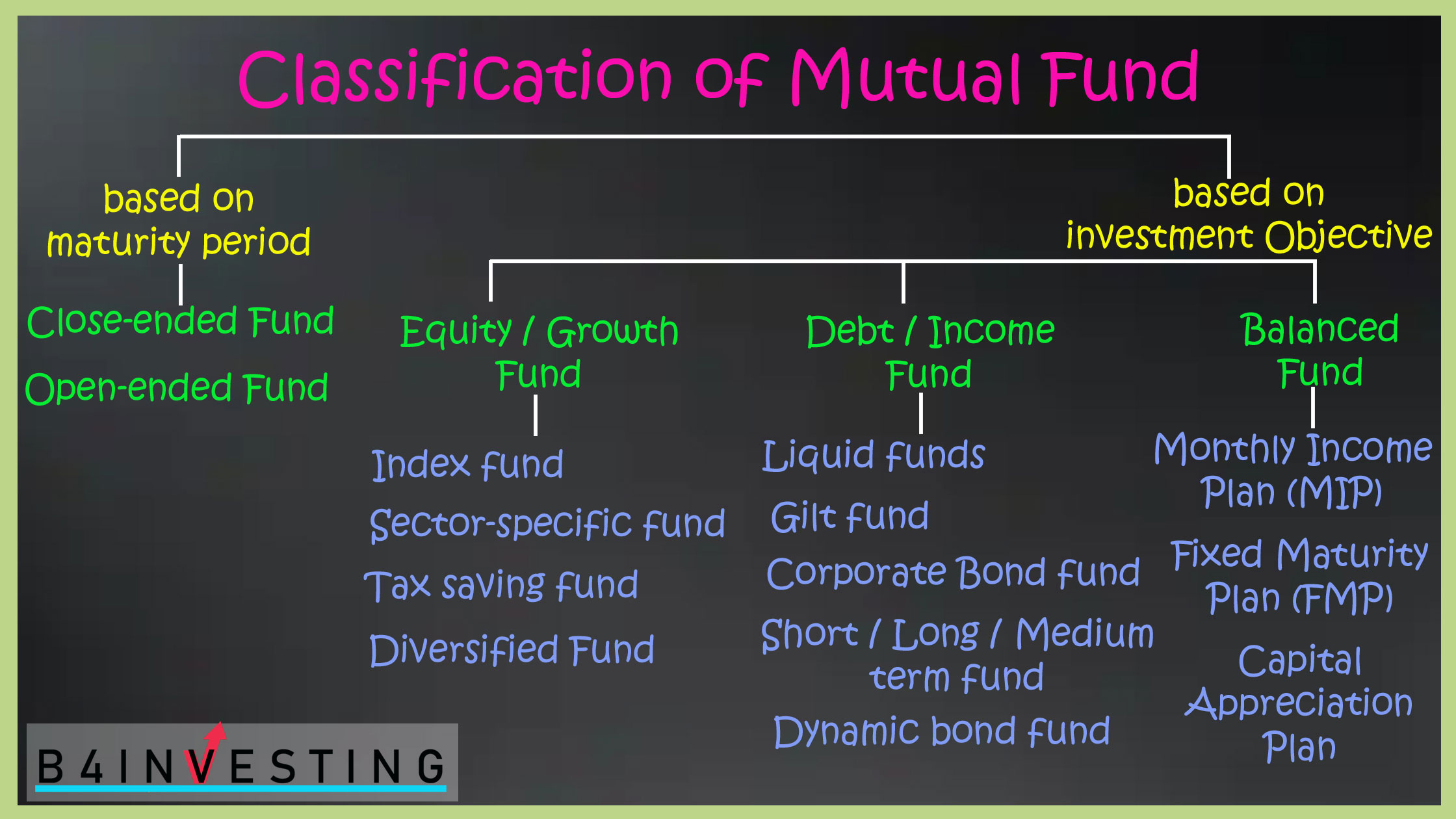

Mutual funds are broadly classified as follows:

I. Funds based on maturity period:

Depending on the maturity period, the funds are classified as Open-ended funds and Close-Ended funds.

- Open-ended Funds:

These funds can be bought and sold on a continuous basis. They are perpetual and do not have a fixed maturity period. Investors can buy and sell their units at the Net Asset Value (NAV) declared on a daily basis. The NAV is based on the value of the fund’s underlying stocks and is generally calculated at the close of every trading day.

As the investors can enter and exit these funds anytime, they offer liquidity and are suitable for the investor who does not want his money to be locked in for a long time. In case of a contingent situation where there is a financial need, the units can be redeemed through the fund house. - Close-ended Funds :

As the name suggests, these funds lock in your investment for a fixed duration, say, 3 years, 5 years or 7 years; and the investor may not be able to able to sell or purchase any units in the interim.

These funds are open only for a specific period of time, i.e., during the launch of the scheme (NFO) and the investor will be able to purchase units in this scheme only at this time, after which he will not be able to purchase any additional units or redeem units.

Though prima facie, the close-ended funds appear to not offer any liquidity since the fund house does not allow redemption of units, some of these funds are traded on the stock exchange like stocks and hence the investors can buy or sell units of a close-ended fund from the stock exchange at the existing market prices. Also, like stocks, the units of these funds are sold at prices determined by the demand and supply of the units of the scheme, either at a price above or below the NAV of the scheme.

Read also: A Beginners Guide to Systematic Investment Plan

II. Funds based on investment objectives:

- Equity/Growth funds: As the name suggests, these funds provide medium or long-term capital growth. These funds majorly invest in equities and equity-related securities and hence these funds have comparatively higher risks. They may invest in a wide range of industries or sectors. These schemes offer different options to the investors such as dividend option or capital appreciation option depending on their preference. An investor who is having a higher risk appetite and looking for capital growth can go for such funds.

Types of Equity/Growth Fund:- Index Funds: Index funds are linked to a particular index such as the BSE SENSEX or the S&P NSE 50 index (NIFTY). Their performance is dependent on the results of the particular index, i.e., their NAVs would rise and fall in accordance to the rise and fall in the index. The portfolio consists of stocks that represent an index and the weightage assigned to each stock is in accordance with the identified index. There are also Exchange Traded Index funds (ETFs) which are traded on stock exchanges.

- Sector-specific Funds: Sector-specific funds invest in the securities of a specific sector or industry such as FMCG, Pharmaceuticals, IT, Oil and Natural Gas, etc. The returns on these funds are based on the performance of the respective sector/industries. Though these funds promise higher returns, they tend to be risky as their performance is directly linked to the performance of that particular sector. The investor must keep a close watch on the performance of these sectors/industries and must exit at the right time.

- Tax Saving Funds (Equity Linked Savings Scheme): These funds offer tax rebates under section 80C of the Income Tax Act, 1961. ELSS mutual funds invest primarily in equities. They are suited for investors with a higher risk appetite and their financial goal is capital appreciation. These tax saving funds come with a lock-in period of 3 years.

- Diversified Funds: Diversified funds invests in companies across multiple sectors and industries. It is a good option for investors with small risk capacity.

- Debt/Income Funds: These funds majorly invest in fixed income securities such as bonds, corporate debentures, Government securities and other money market instruments. These funds are less risky compared to equity funds. They are not affected by market fluctuations but their NAVs are affected by the interest rate fluctuations. An investor looking for a regular and steady income can opt for such funds. However, capital appreciation is limited in such funds.

Types of Debt/Income Funds:- Money Market or Liquid Funds: These funds invest in safer short-term money market instruments such as Treasury Bills, Certificates of Deposit, Commercial paper, etc. for less than 91 days. They offer liquidity and capital maintenance with a moderate income. If you are an investor looking for moderate returns on your surplus funds, then this can be the go-for option.

- Gilt Fund: These funds invest purely in government securities. Government securities have no default risk. But the NAVs of these schemes fluctuate according to the change in interest rates and other economic factors as is the case with income or debt-oriented schemes.

- Corporate Bond Funds: Corporate Bond Funds invest in bonds issued by companies. Corporate bond a good option for investors looking for a fixed but higher income from a safe option. Corporate bonds are a low-risk investment vehicle when compared to debt funds as it ensures capital protection.

- Short Term/ Long Term/ Medium Term Funds: A short-term debt fund refers to a mutual fund scheme which need to be liquified within 1 to 3 years. Medium term funds is a good option for person who wants to meet particular financial goal within time of 3 years. Long term funds is where investment is held for over 5 years.

- Dynamic Bond Funds: Dynamic bond funds invest in debt securities that vary in maturity. Dynamic bonds can switch from long-term to mid-term to short-term securities quickly. Dynamic Bond Funds help in taking advantage of fluctuating interest rates.

- Balanced Fund: The aim of this fund is to provide stability of returns and capital appreciation. They invest in both equity and debt instruments, generally at a ration of 60:40, i.e., 60% in equity and 40% in debentures and bonds.

- Monthly Income Plan (MIP): An MIP invests a small part of the funds (15-25 per cent) in equities. It offers regular income in the form of periodic (monthly, quarterly, half-yearly) dividend payouts.

- Fixed Maturity Plan (FMP): FMP matures after completion of a pre-determined time period. You can make investment during New Fund Offer(NFO) period. After NFO period, no new investment can be made.

- Capital Appreciation Plan: A capital appreciation fund attempts to increase asset value primarily through investments in high-growth and value stocks.

Hope this article provided sufficient insight about mutual funds and mutual fund investment in India.

2 Replies to “CLASSIFICATION OF MUTUAL FUNDS”