EQUITY MUTUAL FUNDS AND 12 TYPES OF EQUITY MUTUAL FUNDS

“Mutual Fund Sahi Hai.”

“Mutual Funds are subject to market risk. Please read offer document carefully before investing.”

These punch lines we often come across at different junctures on television, social media etc. But what are MUTUAL FUNDS and why do they say they are subject to market risk. Do not be scared by this, but the regulator, ie, Securities and Exchange Board of India (SEBI) has made it mandatory to make the investor aware as it involves hard earned money of small investors. Be an aware investor and invest through the right channels.

MUTUAL FUNDS are basically pooling of funds from investors and investing in stocks, bonds, money market instruments, government securities, treasury bills etc by professionally managed fund managers. Mutual Funds offer opportunity to investors to make investment without active participation on daily basis but benefitting from proper asset allocation by professionals.

Also Read: CLASSIFICATION OF MUTUAL FUNDS

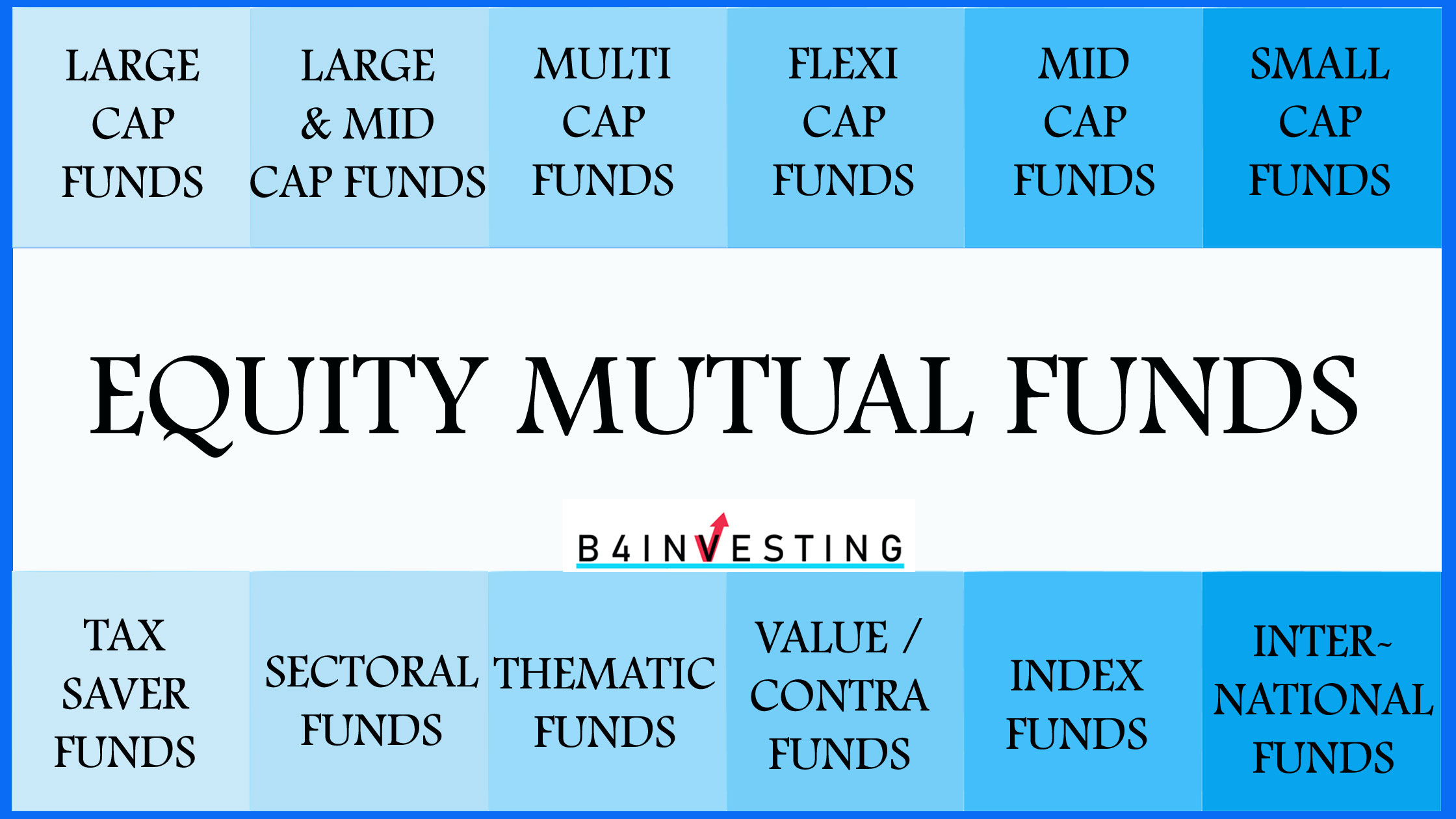

This article we are discussing EQUITY MUTUAL FUNDS and its different categories as done by the regulator. Equity mutual funds basically are ones which primarily invests in stocks. It basically invests in a basket of stocks and can get benefit of the bunch of stocks and diversify his investment rather than buying a single individual stock and having a concentrated approach. These equity funds invest directly into stocks and give highest rate of return but the risk involved is also higher. They depend on market movement and can give good returns in the long run. An investor should be patient and should have conviction on the long term growth story to pan out and reap good returns in EQUITY MUTUAL FUNDS.

Read also: A Beginners Guide to Systematic Investment Plan

EQUITY MUTUAL FUNDS are broadly categorized as follows:

- LARGE CAP FUNDS : These are basically funds with a larger exposure towards stocks which have higher market capitalization. Basically 80% of the portfolio comprises of bluechip stocks. These funds are composition of companies which are consistent performers in nature.

- LARGE & MID CAP FUNDS : As the name suggests, it is a combination of large cap and midcap stocks. The composition should comprise a minimum of 35% of large cap stocks and minimum of 35% midcap stocks. The fund manager is at liberty to decide their percentage as per market conditions.

- MULTI CAP FUNDS : These funds are combination of largecap, midcap and small cap stocks. The minimum composition criteria is 25% of largecap stocks, minimum 25% of midcap stocks and minimum 25 % of smallcap stocks.

- FLEXI CAP FUNDS : Flexicap funds are the ones which are dynamic in nature and invests in largecap, midcap and smallcap category of stocks without any percentage criteria as per the style of the fund manager. Minimum investment of 65% is mandatory in equity and equity related instruments.

- MID CAP FUNDS : These funds have exposure to midcap companies to the extent of minimum 65% in that category only. These funds offer higher risk and higher return compared to largecap funds as these funds invest in company which are aspiring future bluechip companies.

- SMALL CAP FUNDS : Smallcap funds invest 65% of the corpus in stocks which are small size companies. These funds are most volatile in nature but also are the highest return generators over a longer run.

- TAX SAVER FUNDS : Also well known as Equity Linked Savings Scheme (ELSS) are ones which have tax deduction under section 80(C) of Income Tax Act upto Rs 1,50,000/-. These funds have a lock-in of 3 years.

- SECTORAL FUNDS : These funds have exposure to a specific sector or industry and some of them are cyclical in nature. They do carry higher risk as if the sector performs you are lucky to be delivered higher return and vice-versa.

- THEMATIC FUNDS : Funds which have a theme to follow such as emerging market theme or a multinational companies themes belong to this category. Minimum 80% of the fund goes to the theme it represents. They do carry higher risk but offer better diversification.

- VALUE / CONTRA FUNDS : Mutual funds which follow a contrarian strategy or stocks which offer a value buy are part of these funds. The fund managers buy stocks which have sound financials but are underperformers in their sector and over a longer run can outperform and deliver good returns.

- INDEX FUNDS : These funds are similar to ETFs. Major difference to offer between the two is that index funds have a NAV on closing basis at end of day and ETFs are traded throughout the day.

- INTERNATIONAL FUNDS : These funds are basically targeted at investing in stocks globally anywhere outside India. They have majority of the asset allocation done to stocks of overseas market or even global commodities for that part.

EQUITY MUTUAL FUNDS are basically HIGH RISK HIGH RETURN types. There are two approaches to investing in equity mutual fund; basically LUMPSUM and SIP. It purely depends on the investor for availability of funds to invest and his goals, horizon and risk appetite to decide in which category to invest and with which MUTUAL FUND HOUSE. Our basic observation and experience says that different fund houses have different approach and style of working in different categories of schemes.

Fund managers have different styles of investing and some are good at picking large cap stocks, some are good at small cap stocks and some managers are good at debt fund managing. We would urge our esteemed readers to consult their financial advisors and make an investment plan and work accordingly analyzing all the risks and rewards involved and do not copy anyone’s investment style as everyone has different shoes and the same do not apply to all.

A salaried person could prefer SIP as his salary comes every month and investment from it is possible on monthly basis whereas a businessman would prefer Lumpsum sometimes due to availability of funds for investment. Similarly a senior citizen would be more advised to have exposure to debt fund and a youngster would be advised for more of equity fund exposure. A good financial advisor will guide you the best possible option analyzing all possible parameters. Happy and matured investing.

Also Read: A Beginners Guide to Systematic Investment Plan

MUTUAL FUNDS are basically pooling of funds from investors and investing in stocks, bonds, money market instruments, government securities, treasury bills etc by professionally managed fund managers. Mutual Funds offer opportunity to investors to make investment without active participation on daily basis but benefitting from proper asset allocation by professionals.

Also Read: SHARES OR MUTUAL FUNDS? WHICH IS A BETTER INVESTMENT VEHICLE FOR COMMON PEOPLE?

FAQ

When should I start investing in Mutual Funds?

There is no minimum age when one can start earning. When a person starts earning and saving, he/she can start investing in mutual funds. Kids can also invest in mutual funds by money which they receive as gift money.

Do Mutual Funds invest only in stocks?

No, mutual funds invest in debt securities as well. Some mutual funds invest in both equity and debt securities.

What is the co-relation between risk and return?

The greater the risk, the higher the potential for profit or loss. Lower risk is connected with lower return.

Are Mutual Funds suitable for those who don’t want to invest in share market?

Yes, mutual fund invests in debt or hybrid funds as well. So, if you dont want to invest in share market then you can invest in mutual fund.

Do Indian Mutual Funds invest only in India?

Most Indian mutual funds invest only in India but few mutual funds invest in international market too.

What is Systematic Investment Plan (SIP)?

Instead of investing lumpsum amount, one can invest in mutual funds at regular intervals , say once a month or once a quarter.

How do I start a SIP? How do I stop SIP?

For any mutual fund investment, Know Your Client(KYC) is required. A person has to submit certain document. You can stop SIP at any time.

What happens if I miss an instalment?

There is no penalty if you miss instalment.

Who should invest in Debt Funds?

Debt funds are ideal for short term financial goals. So, if your investment horizon is 1 year or 2 years then debt fund is a good option.

2 Replies to “EQUITY MUTUAL FUNDS AND 12 TYPES OF EQUITY MUTUAL FUNDS”