Debt Fund and 18 Types of Debt Funds

Introduction to Debt Funds

Debt funds are mutual funds that invest in fixed income securities such as treasury bills, bonds, government securities, corporate bonds, commercial bills and other money market instruments. In layman terms, when a company issuing debt instruments wants to raise money, it borrows from the investor. As against which they provide a regular and a steady interest.

The basic aim of investing in debt funds is to earn a fixed interest income along with capital appreciation. The maturity period and interest rate are pre-decided by the debt instrument issuers. Thus, they are also called as ‘fixed-income securities.

Read: CLASSIFICATION OF MUTUAL FUNDS

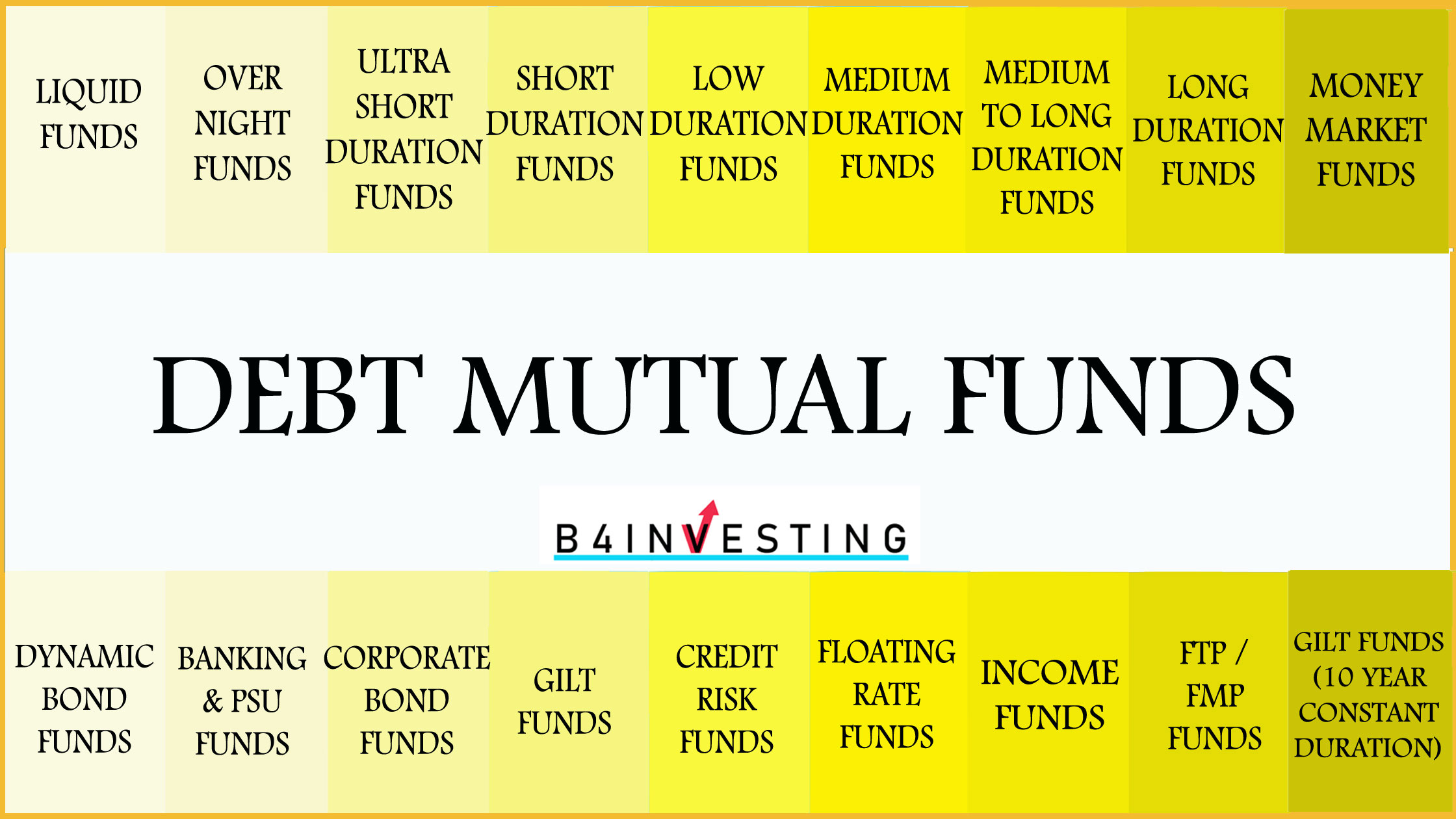

What are the different types of Debt Funds?

We understood what is debt fund. Now Lets read about various types of debt funds. There are different types of debt mutual funds prevailing in the market which suits the diverse needs of the investor. Let’s discuss in detail about each fund for more clarity:

1. Dynamic Bond Funds

These funds are dynamic in nature. The fund manager keeps altering the portfolio mix according to the fluctuation in the interest rate. Dynamic bond funds have different maturity periods as they take interest rate calls and invest in instruments having both short as well as longer maturity periods. The main objective of this fund is to provide best returns in both rising and falling market conditions. It is dependent on the decision of the fund manager and portfolio management. They have a huge AUM (asset under management) having a portfolio worth thousands of crores.

2. Income Funds

Income funds are debt funds that invest in government securities, corporate bonds, debentures, etc. for an extended period. Therefore debt funds having maturity of 4 to 7 years fall under this category. Income funds generate higher returns than a fixed deposit. Investing in these funds can offer tax benefits.

3. Overnight Funds

Overnight funds are debt funds which invests in assets and securities having one day maturity. They also invest in reverse repo and other money market securities that mature in an overnight. The asset holding of an overnight fund is categorized as “Cash and Cash – equivalent”. Every overnight the portfolio of this fund is replaced with new overnight securities. The schemes in this fund are not allowed to invest in risky debt instruments or deposits. These funds earn interest on their debt holdings. They are considered the safest debt funds with zero interest risk and credit risk. Moreover, they are low cost as their debt holding are not actively managed.

4. Short Term Funds

Debt funds having short duration i.e., from 1 year to 3 years are termed as short term funds. They are more suitable for conservative investors because these funds are not affected by interest rate movement. They offer stable returns for moderate risk. Short term funds invest in money market instruments as CD’s, CP’s, T-bills, etc. Let us discuss each of them in brief:

5. Money Market Funds

Money market funds are short term debt funds whose average maturity is one year. The maturity of instruments traded in this market varies from overnight to 1 year. They are as follows:

T-Bills – The government issues T-bills to raise funds for a duration upto 365 days. They are very safe as they are issued by the government. Moreover, lower risk is accompanied by lower returns.

Certificate of Deposits (CD’s) – Certificate of deposit is a financial instrument having fixed income governed by the RBI and issued in a dematerialized form. Only schedule commercial banks can issue CDs on a discount provided on face value. They are not publicly traded. Banks are not permitted to buy back them before their maturity.

Commercial Paper’s (CP’s) – Commercial papers are termed as short term debt instruments issued by large banks and corporation to raise funds to meet their short term financial obligation generally for a duration upto 1 year. It was introduced in the year 1990 as an unsecured money market instrument in the form of a promissory note. Only those companies having high credit rating often issue CPs to diversify their source of short term obligations.

Read also: A Beginners Guide to Systematic Investment Plan

6. Ultra-Short-Term Funds

These funds lend to companies only for a period of 3 to 6 months. They are low risk funds because of their low lending duration. Ultra – short term funds are ideal for those who want to keep aside their money for a couple of months or a few weeks. They give similar or slightly higher returns than a bank deposit of same tenure.

7. Low Duration Funds

Low duration funds invest in short term securities such as money market, government securities, corporate bonds, etc. whose duration lies between 6 to 12 months. Unlike overnight funds and liquid funds, they hold assets with longer maturity and lesser credit quality. They have low interest rate risk and credit risk. These funds earns interest as well as capital gains on their debt securities.

8. Medium Duration Funds

Medium duration funds invest in debt securities and money market instruments having a time horizon of 3 to 4 years. Thus, these funds are suitable for conservative investors. They have longer duration than overnight funds, ultra-short-term funds, short term funds and low duration funds. The average return of these funds ranges from 7 to 9%. They are tax efficient than bank deposits as these funds have tenure for 3 years or more.

9. Medium to Long Duration Funds

Medium to long duration funds invests in debt securities and money market instruments having an average maturity of 4 to 7 years. Although these funds provide higher returns but are sensitive to interest rate changes. Those who want to invest in these funds to be able to tolerate risk as they are not completely risk free.

10. Long Duration Funds

Long term duration funds invest in long term fixed income securities. As per SEBI norms these funds should invests only in debt and money market instruments having a maturity of more than 7 years. However, mutual fund advisors do not advise regular debt investors to invest in long duration funds as they are highly sensitive to interest rate movements.

These funds benefits when RBI starts cutting its policy rates. They can go upto a double digit returns during an easy rate period. They lose heavily when RBI hikes policy rates.

However, if you intend to invest for a longer duration and have knowledge of interest rates in the economy, you can avoid losses.

11. Liquid Funds

Liquid funds are debt funds that invest in short term securities such T-bills, repos, government securities, commercial papers or certificate of deposits. As per guidelines issued by SEBI liquid funds are permitted to invest in money market instruments with a maturity up to 91 days. The returns are dependent on the market price of the securities. The returns on these funds are more stable compared to other debt funds as prices of short-term securities do not change frequently.

12. Gilt Funds

Debt funds which invest only in fixed interest-bearing securities and bonds that are issued by the central and the state government are called Gilt funds. They are invested in different maturity instruments and are less risky.

When a central or state government are in need of funds they resort to RBI. RBI then raises the fund from other banks and insurance institutions and lends it to the central/state government. RBI issues G-secs in exchange having fixed tenure. Gilt funds invest in these securities and once they mature, the fund receives a payout in return of these securities. Gilt funds are an ideal choice for risk averse fixed income investors.

13. Gilt Funds (10 year Constant Duration)

Gilt funds with 10year constant duration are open ended debt funds that invest 80% of its assets in government securities. Its duration is 10 years or more. These funds outperform when interest rates fall. As compared to other debt funds they offer higher returns. It is considered a safe investment due to its sovereign ratings. It is suitable for investors who can afford to carry least risk. Gilt fund is tax efficient as compared to FD’s for high income tax bracket investors.

14. Credit Opportunities Fund

Credit opportunities Fund are new debt funds that do not invest according to the maturity period. They invest to earn higher returns by taking a call credit risk and by keeping a hold on low rated bonds which have high interest rates. They are highly riskier funds compared to other debt funds.

15. Fixed Maturity Plan (FMP’s)

Close ended debt funds such as FMPs invest in fixed income securities like government securities and corporate bonds. They have a fixed time frame for which your money is locked in. This time frame can be in months or even years. Investment in these funds are made only during the initial offer period. It is similar to a fixed deposit that yield higher tax effective returns.

16. Floating Rate funds

Floating rate funds are debt funds which invest in fixed income securities or floating rate securities like bank loans, bonds, etc. When you invest in this type of fund, around 75 to 100% capital is invested in securities with a flexible interest rate. The benefit of investing in this fund is that it is less sensitive to changes in the interest rate as compared to other debt funds. They are available as both short term as well as long term funds.

17. Banking & PSU Funds

Banking & PSU funds are open ended debts funds that invest 80% of their corpus in debt instrument such as debentures, bonds, CD’s, etc. of Public sector undertakings, banks and Public Financial Institutions. These funds invest in debt securities having low average maturity and high liquidity. Investors seeking higher returns compared to bank FD’s can go in for these funds as their investment is in AAA-rated categories which boasts of high credit ratings. As government ownership is involved, repayment is assured. Like ultra-short term funds, they have low risk profile and return potential like an income fund. Investors looking to invest for short term to medium term can go in for these funds as average maturity period is 1 to 2 years.

18. Corporate Bond Funds

Also termed as Non-convertible Debentures (NCD’s), corporate bonds can be issued by any company. Companies require capital for various activities such as daily operations, future expansion or even growth. To attain this, the company has two options- equity or debt instruments. Amongst the two debt is the safest option as it does not affect the shareholders directly. Thus, most companies prefer to issue debt instruments to raise capital for their activities. Bank loans can be expensive for them; thus bonds or debentures can be an economical option to raise capital.

When you buy a bond, it means the company is borrowing from you. They will repay the principal amount on the maturity mentioned in the agreement. Uptill then you receive interest known as coupon. In India coupon as paid twice a year.

Corporate bonds are suitable for investors seeking fixed but higher returns. They low risk instruments ensuring capital protection. Their investment horizon is generally 1 to 4 years. It could be tax efficient if you remain invested upto 3 years and fall under high income tax bracket.

Also Read: EQUITY MUTUAL FUNDS AND 12 TYPES OF EQUITY MUTUAL FUNDS

Conclusion

From the above explanation on the meaning and different types of debt funds we can come to a conclusion that debt funds provide lower but steady returns. Debt Mutual Funds ensure stability of your portfolio as they are traded in fixed income market which are more stable as compared to equity markets.

Everyone needs a financial plan that is designed to meet various financial goals of an individual. Investment in debt funds is best suited for short term goals that are to be achieved within a span of 1 to 3 years. So the investor must choose the fund as per his risk appetite.