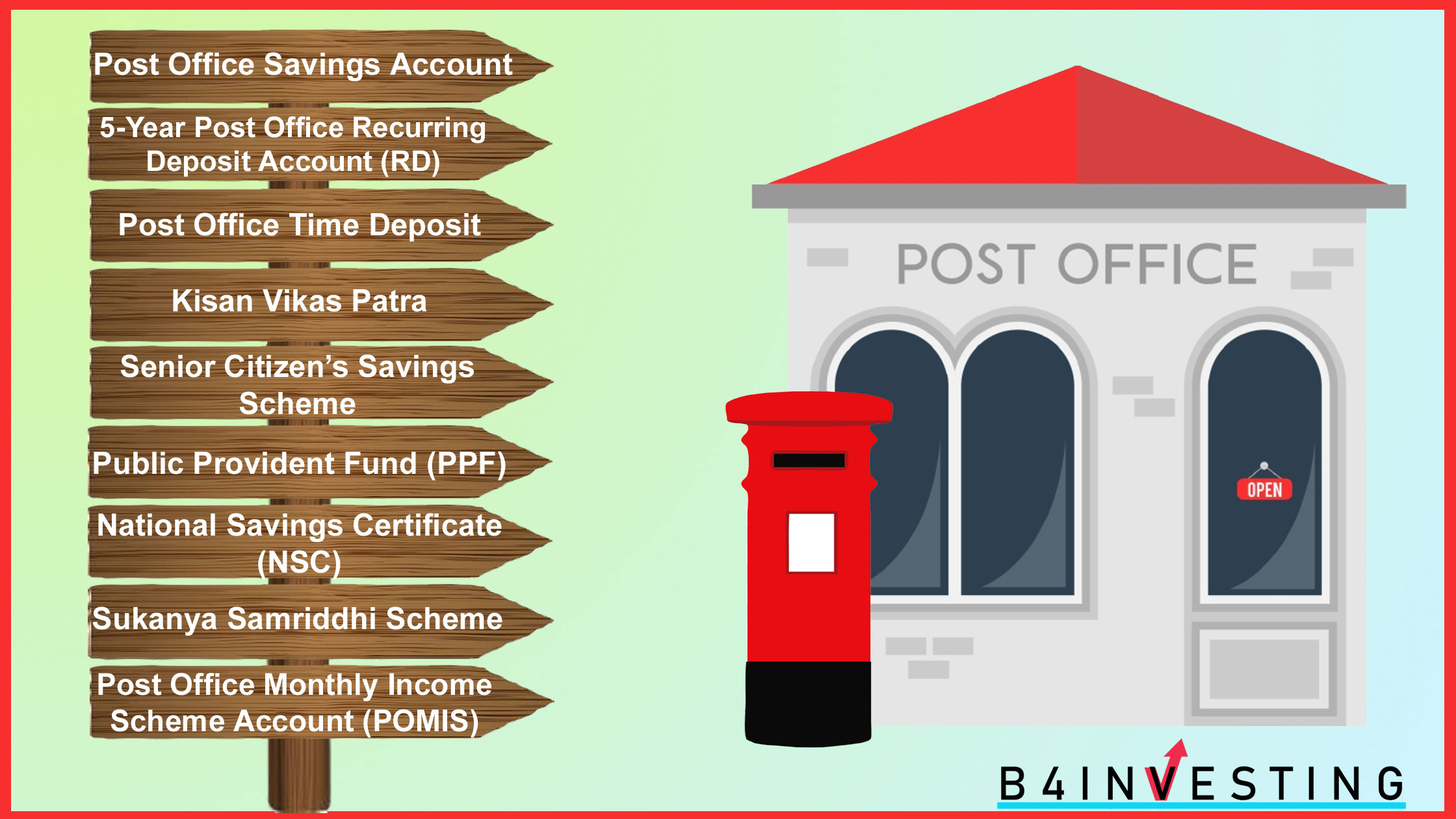

POST OFFICE SAVING SCHEMES

Post office of India offers various investment options known as Post office saving scheme. Lets read about all schemes in details.

Post Office Savings Account

- By depositing Rs 20, you can open a saving account with post office

- Can be maintained with minimum Rs 50 in account

- Only one account can be opened with one post office

- Post office saving account has 4% interest rate

- On request, cheque book, ATM card, e-banking and mobile banking service is available

5-Year Post Office Recurring Deposit Account (RD)

- Post office Recurring Deposit is a monthly investment plan for a fixed period of 5 years

- It gives 5.8% interest per annum (compounded quarterly)

- Minimum Rs 10 per month and any amount in multiples of Rs 5 can be invested. There is no upper limit for the investment

- Multiple, joint account can be opened

- Default fee of 5 paise for every 5 rupees in case if monthly investment is not paid

- Upto 50% of the balance can be partially withdrawn after a year

- Good option for monthly saving

Post Office Time Deposit

- Different tenure options for investment

- Rate of interest 5.5% for 1-year to 3-year time deposit

- Rate of interest 6.7% for 5-year time deposit

- Rs 200 is minimum amount invested and no upper limit

- Multiple, joint accounts can be opened

- post office time deposit qualifies for the deduction under Section 80C of The Income Tax Act, 1961

Post Office Monthly Income Scheme (POMIS)

- POMIS offers regular monthly income on the lump sum investment made by the investor

- Minimum amount for investment is Rs 1500 and maximum investment amount is Rs 4.5 lakhs and Rs 9 lakhs for joint accounts

- POMIS has a lock-in period of five years and upon maturity, the depositor can choose to either withdraw or reinvest the entire amount into the scheme

- Current rate of interest rate for POMIS is 6.6% per annum payable monthly with the maturity period of 5 years

- Single person can open multiple accounts with maximum investment of Rs 4.5 lakh all together

- Investor can withdraw the deposit after 1 year with penalty of 2% on deposit if withdrawn between 1 year-3 years and 1% penalty on withdrawals after 3 years

Kisan Vikas Patra (KVP)

- KVP is introduced for farmers

- KVP offers an interest rate of 6.9% compounded annually

- The invested amount doubles every 124 months (10 years and 4 months)

- Denominations of Rs 1,000, Rs 5,000, Rs 10,000 and Rs 50,000 can be invested

- Minimum limit of investment is Rs 1,000 and it has no maximum limit

- Certificates are easily transferable and can be endorsed to third person

- Certificate is comparatively liquid as it offers encashment facility after 2.5 years of investment

- Tax benefit is not available for KVP

- KVP has lock in period of 30 months so investor can not withdraw money in this lock in period

Post Office Senior Citizen’s Savings Scheme (SCSS)

- Senior Citizen’s Savings Scheme (SCSS) is a post office saving scheme for senior citizens backed by government of India

- Pays regular income in the form of interest

- The current SCSS interest rate is 7.4%

- Minimum limit of investment Rs 1000 and maximum limit if Rs 15,00,000

- SCSS has 5 years lock in period

- Investments into SCSS qualify for tax exemption under Section 80C. But, the interest income is taxable

- For withdrawals within two years, a penalty of 1.5% on the investment amount is charged, Penalty of 1 % is levied after 2 years of deposit

- An individual can hold multiple accounts in his name or in joint holding with his spouse

- Account can be extended for three more years after the scheme matures

Public Provident Fund (PPF)

- Public Provident Fund (PPF) is a long-term investment for a period of 15 years

- PPF is currently offering an interest rate of 7.1% per annum and its compounded yearly

- The Ministry of Finance revises the PPF interest rates every quarter

- Anyone can invest

- Minimum amount for investment is Rs 500 and maximum of Rs 1.5 lakhs in a financial year

- Once invested, the investment is locked-in for a tenure of 15 years

- 50% of the balance of the preceding year or end of 4th year can be withdrawn

- Investments can be made in lump sum or in 12 equal instalments

- Account can only be opened in a single holding form

- You can invest in the name of minor also without exceeding your maximum limit of investment by combining balances of all your accounts

- Maturity period can also be extended to 5 more years on completing the period of 15 years and keep extending it

- Can be closed prematurely after 5 years from account opening but only for serious ailments or higher education

- Partial withdrawal is also permissible after the expiry of 5 years from the end of the year in which the account is opened

- Investor can take loan from the 3rd financial year to the 6th year of account opening

- Investment in PPF account qualifies for tax deduction under Section 80C of The Income Tax Act

- Interest received is also fully tax-free

National Savings Certificate (NSC)

- National Savings Certificate (NSC) has a maturity period of 5 years

- The current NSC rate of interest is 6.8% per annum compounded half-yearly but payable at maturity

- Minimum amount invested is Rs 100 and maximum there is no limit

- Investments can be done in denominations of Rs 100, Rs 500, Rs 1,000, Rs 5,000 and Rs 10,000

- NSC has a lock in period of 5 years

- Interest is automatically reinvested back into the scheme

- Investment in NSC is tax deductible under Section 80C of The Income Tax Act

- The interest that is reinvested is eligible for a tax deduction as well

- Income tax has to be paid on the interest income at the end of 5 years

- NSC certificates can be pledged as security for availing bank loans

- Transfer of certificate from one person to another person is allowed only once during the investment tenure

Sukanya Samriddhi Scheme

- Government of India initiated Sukanya Samriddhi Scheme to supports the ‘Beti Bachao, Beti Padhao’ campaign

- Current interest rate is 7.6% per annum and it is compounded annually

- The minimum amount of investment is Rs 1000 and maximum of Rs 1,50,000 in a financial year

- Parents or guardian can invest in this scheme on behalf of girl child before 10

- Investment in the Sukanya Samridhhi Account is tax deductible under Section 80C up to Rs 1.5 lakh per annum

- Girl’s age should be 10 years or less on the date of opening the account

- The interest on the Sukanya Samriddhi Account is also tax free and the maturity amount is tax free

- Investment will mature after the lock in period of 21 years but at the age of 18, 50% of the amount can be withdrawn for the purpose of higher education

- The account will also have to be closed if the girl child becomes an NRI or loses her Indian citizenship

- A parent/guardian can open maximum of two accounts in the name of two different girl children

- There will be a penalty of Rs 50 if minimum amount is not deposited in a financial year

List of Post Office Saving Schemes

| Type of investment | Rate of Interest | Lock-in Period | Minimum Investment | Maximum Investment | Taxation |

| Post Office Savings Account | 4% | NA | Rs 20 | No limit | interest up to INR 40,000 per annum is tax-free as per investors’ income tax slab rate |

| 5-Year Post Office Recurring Deposit Account (RD) | 5.8% | 5 years | Rs 10 per month | No limit | Taxable as per income tax slab applicable on an individual’s earning |

| Post Office Time Deposit Account (TD) | 5.5% | 1,2,3, 5 years | Rs 200 | No limit | Tax benefits up to 5 years under section 80C on deposits |

| Post Office Monthly Income Scheme Account (MIS) | 6.6% | 5 years | Rs 1500 | Rs 4.5 lakhs | Interest earned under the scheme is taxable |

| Senior Citizen Savings Scheme (SCSS) | 7.4% | 5 years | Rs 1000 | Rs 15,00,000 | Investment qualifies for tax deduction under Section 80C of the Income Tax Act, 1961, interest is taxable as per investors income tax slab rate |

| Public Provident Fund Account (PPF) | 7.1% | 15 years | Rs 500 per financial year | Rs 1.5 lakh per financial year | Investment, returns and maturity amount is exempt from tax |

| National Savings Certificate | 6.8% | 5 years | Rs 100 | No limit | Tax deduction up to Rs. 1.5 Lakh p.a. under section 80C |

| Kisan Vikas Patra (KVP) | 6.9% | 30 months | Rs 1000 | No limit | Interest is taxable but no tax on the amount received on maturity |

| Sukanya Samriddhi Accounts (SSA) | 7.6% | 21 years | Rs 1000 per financial year | Rs 1.5 lakh per financial year | Investment, returns and maturity amount is exempt from tax |

TAKEAWAY:

Investors who wants to invest in no-risk investment option along with safe and secured return generation can opt for above postal investment schemes. The minimum investment amount is low and affordable so anyone can invest in post office saving schemes. Saving schemes like National Savings Certificates, Sukanya Samriddhi Accounts, and PPF offer attractive interest rate and zero financial risks.