THE STRUCTURE OF FINANCIAL MARKET IN INDIA

We are all aware of the concept of a general and physical market: A physical setting where goods and commodities are bought and sold. However a financial market is a virtual facilitation where financial instruments of various categories are purchased and sold. These instruments may include anything from securities and bonds and right up to forex and derivatives.

Thus it is an exchange of financial commodities of value that reflect and affect demand and supply of such instruments.

Read also: A Beginners’ Guide to Commodity Trading and Exchange

Understanding financial markets as such may seem complex, however in reality, it is no rocket science if broken down into small segments that are easily understandable on their own.

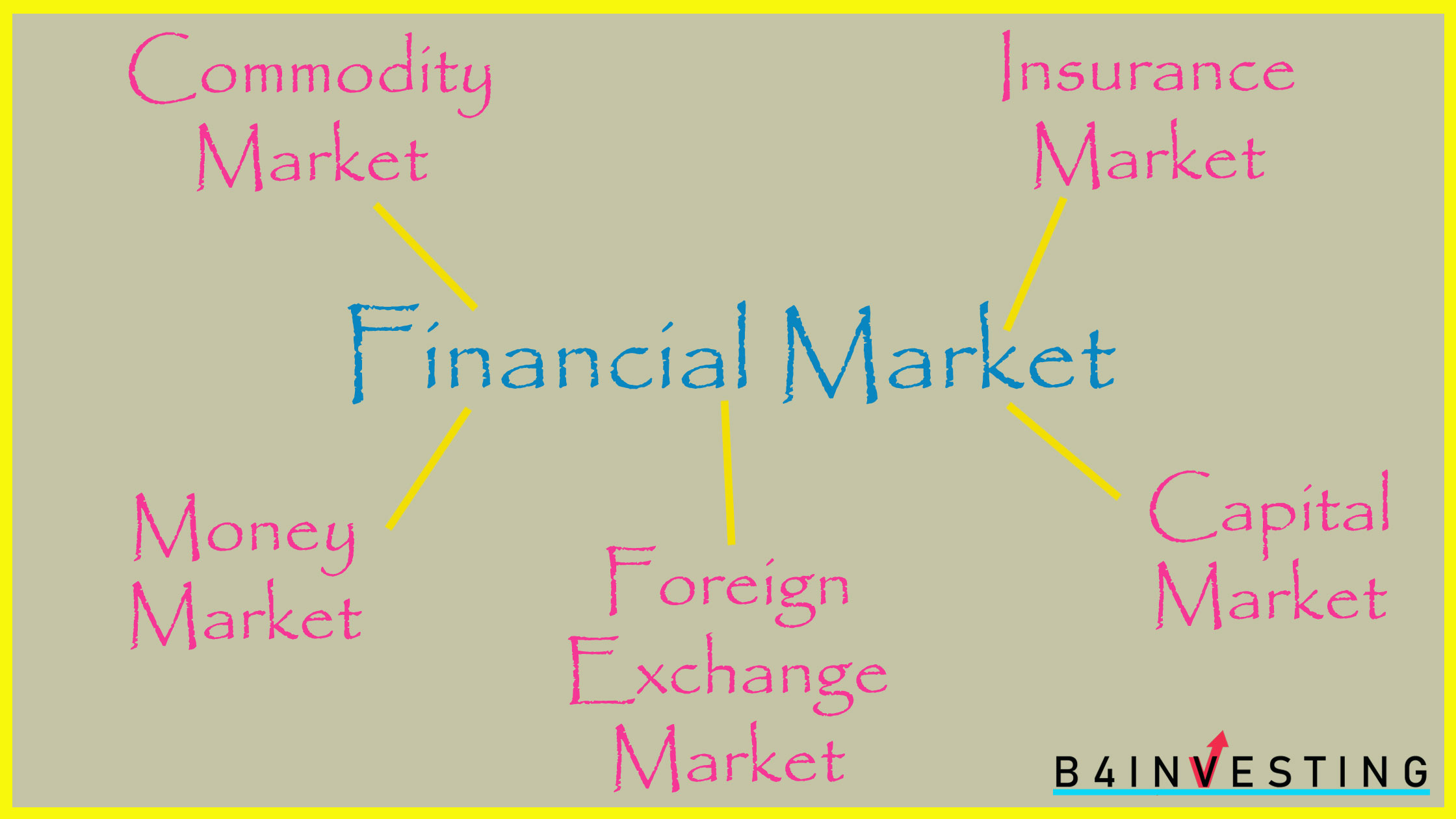

The structure of the Indian financial market is broadly classified into the following five major segments:

- Capital Market

- Money Market

- Insurance markets

- Foreign Exchange Market

- Commodity Market

CAPITAL MARKET

Capital Market is a channel by which the flow of funds is directed from the Investors to fund seekers, traded as a financial assets with long term maturity. It facilitates purchase and sale of holdings such as equities, debentures and securities. It provides long term financial resources in the form of debt equity for the corporate/ private sector or government sector

The existence of such capital markets is great boon to any economy. Primarily, it helps in efficient mobilizing of economic resources to further growth and development and in turn facilitate economic growth for the country. This is made possible through constant investment activities, thus making funds available in the capital markets continuously. As a domino effect, it stabilizes and systemizes the security prices thus creating an ecosystem for its own sustenance.

Broadly, Capital Markets are classified into two major divisions

(i) Primary Markets

(ii) Secondary Markets

Primary Markets: Commonly referred as New Issue Markets, primary markets basically help provision of stock or shares to the public from the organization for the first time. Thus corporation raise investments through this platform through Initial Public offerings (IPO). These are largely done through issuing shares and bonds.

Secondary Markets: The market place which actually facilitates the exchange of equites and stocks, which were originally issues by the corporations is called secondary markets. Previously issued stocks are purchased and sold in this market. Individuals and agencies that have bought stocks in the primary market may take an exit in the secondary market by selling them off.

Read also: A Beginners Guide to Systematic Investment Plan

Instruments in Capital Markets:

Security Market:

Commodities, Derivatives, Shares and Debentures

Derivatives: It is an instrument which is promised to be purchased or sold by the buyer or seller at a particular date at a pre-fixed rate. E.g. Future and options.

Shares: Individual units of corporations that hold a monetary value, issued to investors are called shares. They are a means of creating capital for the company.

Debentures: A financial debt instrument issued by a company for a long term to raise capital is called debentures.

Non-Security Market: Provident Funds, Bank Deposits, Mutual Funds etc.

Provident Funds: Funds where the employees and Employers contribute during the tenure of employment in return for a rate of Interest on retirement is called provident fund.

Bank Deposits: Money stored in banking institutions for a rate of Interest in savings account, fixed deposit account etc. are referred as bank deposits.

Mutual Funds: A pool of money collected from various individual investors in order to invest in different combination of financial securities for short or long term is known as Mutual Funds.

Intermediaries in Capital Market:

Professional liasoning agencies that assist in mobilizing the resources of the parties having surplus funds to the deficit ones termed as Financial Intermediaries.

The major financial intermediaries in India are listed a follows:

- Banks

- Insurance Companies

- Mutual Funds

- Stock Exchanges like BSE, NSE

- Pension Funds etc.

Also Read: SHARES OR MUTUAL FUNDS? WHICH IS A BETTER INVESTMENT VEHICLE FOR COMMON PEOPLE?

MONEY MARKET

As opposed to the capital market, the money market is all about short term investments. Talk about lending and borrowing from one day to one year’s duration, then we ought to be talking about the Money market. Thus it allows trade in securities that have a maturity period of less than one year. With lesser risk of loss and faster liquidity.

Instruments in Money Markets:

Money Market Mutual Funds: Money pool that is invested in short term debt securities and money markets is defined as MMMFs. These are considered as safe investments with considerable returns.

Term Money / Notice Money / Call Money: Money issued on demand for a very short duration forms a considerable part of money Market. If borrowed for one day, it is termed as call money, for one to fourteen days it is termed as notice money and for more than fourteen days it is referred as “Term money”.

Treasury Bills: Issued by the central Bank, T-bills are safe investment instruments bought at a discounted rate at the time of purchase and paid at par at the time of Maturity by the central bank. The Interest rate is determined by the market forces of demand and supply at the time of purchase. It may be issued for 91 or 182 or 364 Days.

Commercial Bills: Bills of exchange arise out of genuine trade transactions promising a certain amount after a fixed period of time by individuals or financial institutions.

Certificate of Deposit: A safe instrument for saving, a deposit certificate for a period of fixed maturity.

Commercial Papers: Also known as CPs, these are short term debt instruments are issued for a duration of 7 days to a year. They are unsecured and thus without collaterals, therefore only large financial institutions and corporations can issue these as they possess considerable financial capital.

INSURANCE MARKET

Insurance market sector consists of various companies offering risk management in the form of contracts insuring the buyer from adverse circumstances on occurrence of pre decided events for E.g. death, accident, loss, theft etc. They guarantee a certain amount of payment on the occurrence of these events.

Types of Insurance available for Investors are:

FOREIGN EXCHANGE MARKET

Forex market is a global currency exchange marketplace that allows trading of national currencies against each other to gain advantage of their difference in values. This market has linked globally (electronically) and operates all weekdays for 24 hours. The forex market in India is supervised strictly by the Central Government in order to monitor all transaction in relation to it and thus manage healthy levels of forex in the country. There are various acts implemented in India like FEMA and FERA to enable effective management of the same.

COMMODITY MARKET

Commodity Markets involves buying and selling of goods and raw products and natural resources like metals, minerals, food-grains etc. The following boards act as intermediaries in commodity trading.

MCX (Multi Commodity Exchange): Commodities traded Consist-Metals, Bullion, Agricultural Commodities and Energy.

NMCE (National Multi Commodity Exchange): Commodities traded Consist of: Oil and oil seeds, certain spices, other seeds etc.

NCDEX (National Commodity and Derivatives Exchange): Commodities traded Consist mainly of agricultural products.

ICEX (Indian Commodity Exchange): Commodities traded Consist mainly of diamond steal, rubber and agricultural products

CONCLUSION:

Thus the Indian Financial Market has been organized strategically to enable effective organization and administration in order to promote national economic growth and development.