Insurance and Different Types of Insurance

When it comes to financial planning, there are lot of options available to invest. But seeing this COVID scenario, everyone is more concerned about protection. People have started understanding the importance of insurance in one’s life. Inflation is rising, lifestyle is changing, people have started living in nuclear family, so the insurance is the first step of financial planning.

What is insurance? Insurance is something which people buy to protect themselves from losing money. In return, a person gets money if something happens to his insured thing or life | health of insured person. For example,

- A person buys an insurance for car and if something happens to his car, he gets money in return from insurance company for his damage to the car.

- A person buys life insurance to protect future of all his family members who are totally dependent on him. So, if something happens to a person, his family will be secured financially.

“The time to repair the roof is when the sun is shining.”

– John F. Kennedy

So, future is unpredictable. You should protect your family, your property, health from your early age.

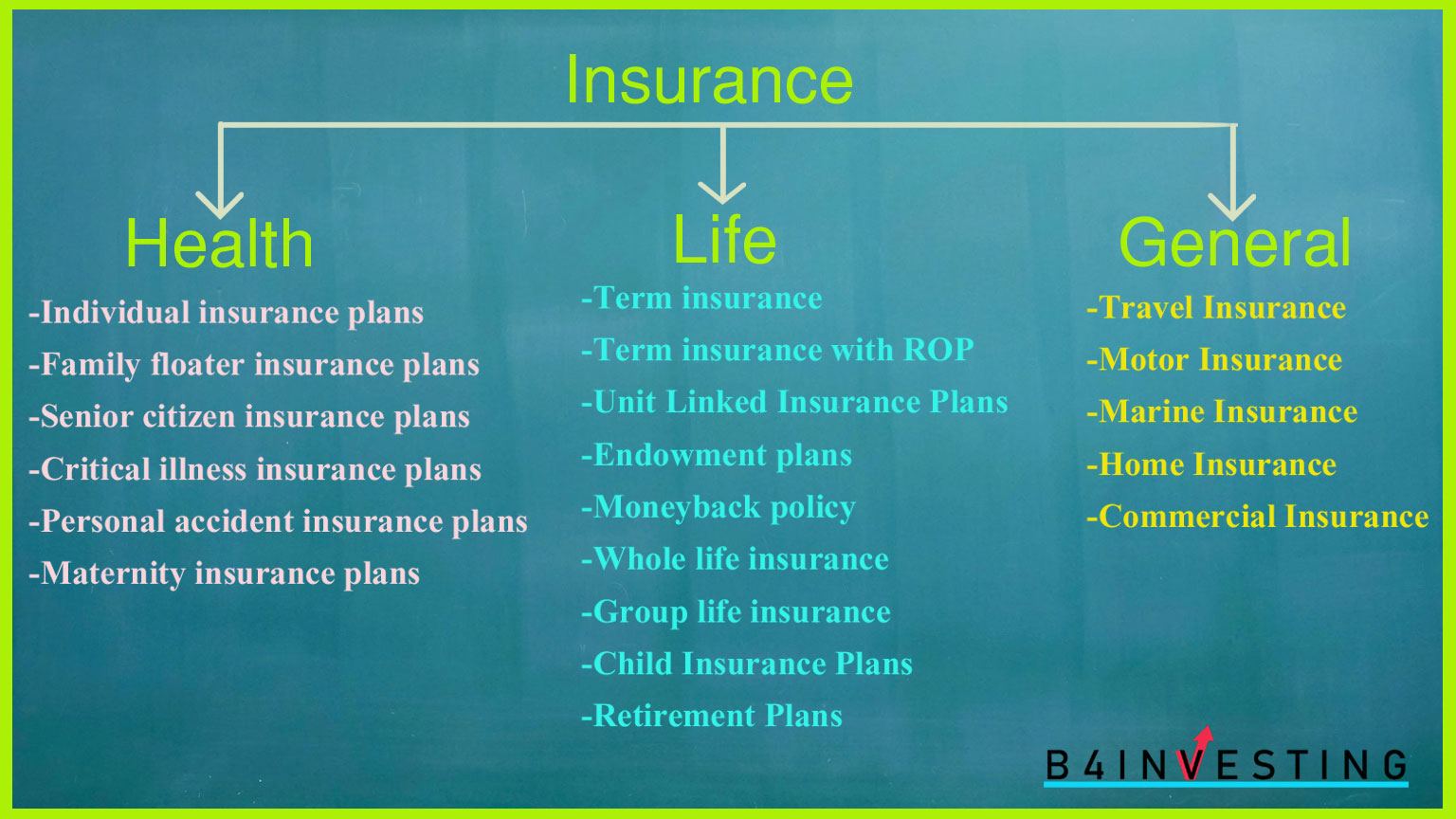

Mainly, there are 3 types of insurance.

- Life Insurance

- Health Insurance

- General Insurance

Also Read: How to Plan your Insurance & Insurance Tenure

Life Insurance

Its very important to secure future of your loved ones who are dependent on you. They should have enough money to continue their lives in your absence. So, life insurance should be your first choice. There are many types of life insurance:

Term insurance

Term insurance is a type of insurance where a nominee gets death benefit if insured dies during specified period. If insured survives until the end of specified period then insured’s policy can be terminated or policyholder can renew it for next term. Term life premiums are based on a person’s age, health, and life expectancy.

Term insurance with Return of Premium

Terms insurance with ROP offers death benefit along with premium return to policy holder whereas term life insurance offers only death benefits. If a policy holder dies during specified term, a policy holder will get death benefit but if a policy holder survives until specified period, then policy holder gets back all his premium paid. Premium rate of this policy is higher than term life insurance as it guarantees the sum of premiums paid by policy holder.

Unit Linked Insurance Plans

This is a combination of insurance and investment. If the policy holder dies in specified time, then the nominee will get the death benefit. If the policy holder survives then a policy holder will get a maturity value of ULIP. This will be the amount generated by ULIP investment in equity or debt. The policyholder is allowed to choose ULIP funds and asset classes to generate these funds.

Endowment plans

It’s a combination of insurance and saving. The policyholder gets lumpsum amount if policy holder doesn’t die during specified term. This lumpsum amount can be used for children’s education, retirement planning, buy a house. If policy holder dies in specified term, then a nominee will get sum assured.

Moneyback policy

Moneyback policy gives a policyholder money during policy tenure. It gives a percentage of sum assured at regular interval during policy term. If a policy holder lives until the term, policy holder will get the remaining money and bonus at the end of policy term. If a policy holder dies during term, then a nominee will receive the sum assured regardless number of instalments paid.

Whole life insurance

Whole life insurance provides a policy holder a coverage throughout lifetime. It also has a saving component where cash accumulates and it increases over a period of time. A policy holder can withdraw this cash.

Group life insurance

Group life insurance is generally offered by an employer or any organization. This insurance is very less expensive. An employee can be part of this group life insurance until working with employer. An employee has to pay very little premium or no premium. An employer pays the major part of it.

Child Insurance Plans

This plan is investment plus savings. This type of insurance provides money for your child’s education, marriage. With such type of policy, a person can start investing in children’s plan right from the child is born. This investment can help a child to fulfil his goal and dream.

Retirement Plans

This plan provides you income during your retirement when you don’t have any job to earn income. On maturity of this policy, a policy holder gets regular income which is known as pension or annuity.

Health Insurance

If any person in family has a medical emergency, your hospital bills which can be huge in number (depend on the emergency) are covered by insurance company if you have taken health insurance. Insurance company provides coverage like day care, surgical, critical illness depending upon what plan you have chosen. There are different types of insurance:

Individual insurance plans

This type of plan is meant for individual only. Policyholder will receive the assured sum during hospitalization. An individual can claim upto what sum is assured.

Family floater insurance plans

As the name suggests, in this plan, the whole family is insured. A person can cover his/her whole family under this plan. The sum insured is shared among family.

Senior citizen insurance plans

This plan is for people who are 60 or above. Older a person gets, there is higher chance of for her/him to get some other health issue. This plan covers critical illness, cashless hospitalisation, pre-existing disease.

Critical illness insurance plans

This plan covers the insured against life threatening disease like cancer, heart attack. Treatment expenses for such disease is high so this plan is really helpful for fighting such life-threatening disease.

Personal accident insurance plans

Accident can happen at any time and this accident can cause minor to serious injuries so it’s better to be secured. This plan provides complete financial protection against accidental death, accidental bodily injuries, partial/total disability, permanent/temporary disability, body injuries resulting tom accident.

Maternity insurance plans

Pregnancy is an important milestone in life. This plan covers baby delivery option, hospitalisation, medicines, surgeon fees, doctor consultation.

General Insurance

Like your life and health, you can protect your property too. The insured is assured of financial protection in case of any damage or loss of that particular asset.

Travel Insurance

It covers the financial loss arising due to medical or non- medical emergencies which includes loss of baggage, passport, accidental deaths etc.

Motor Insurance

To be eligible and legally drive in the country motor insurance is mandatory. It can be categorised into Third party Liability and Comprehensive Package Policy. Digit Insurance is another facet which acts as a shield to your vehicle

Marine Insurance

It covers any damage/loss caused to cargo vessels, ships, terminals, etc. in which the goods are transported from one point of origin to another.

Home Insurance

It is comprehensive policy that covers all the assets and valuables with respect to your home.

Commercial Insurance

It covers financial losses or damages arising in business operation. It may include, marine insurance, engineering insurance, property insurance, employee benefit plans etc.

Also Read: What is General Insurance? Different types of General Insurance

3 Replies to “Insurance and Different Types of Insurance”