Inflation : Everything about Inflation

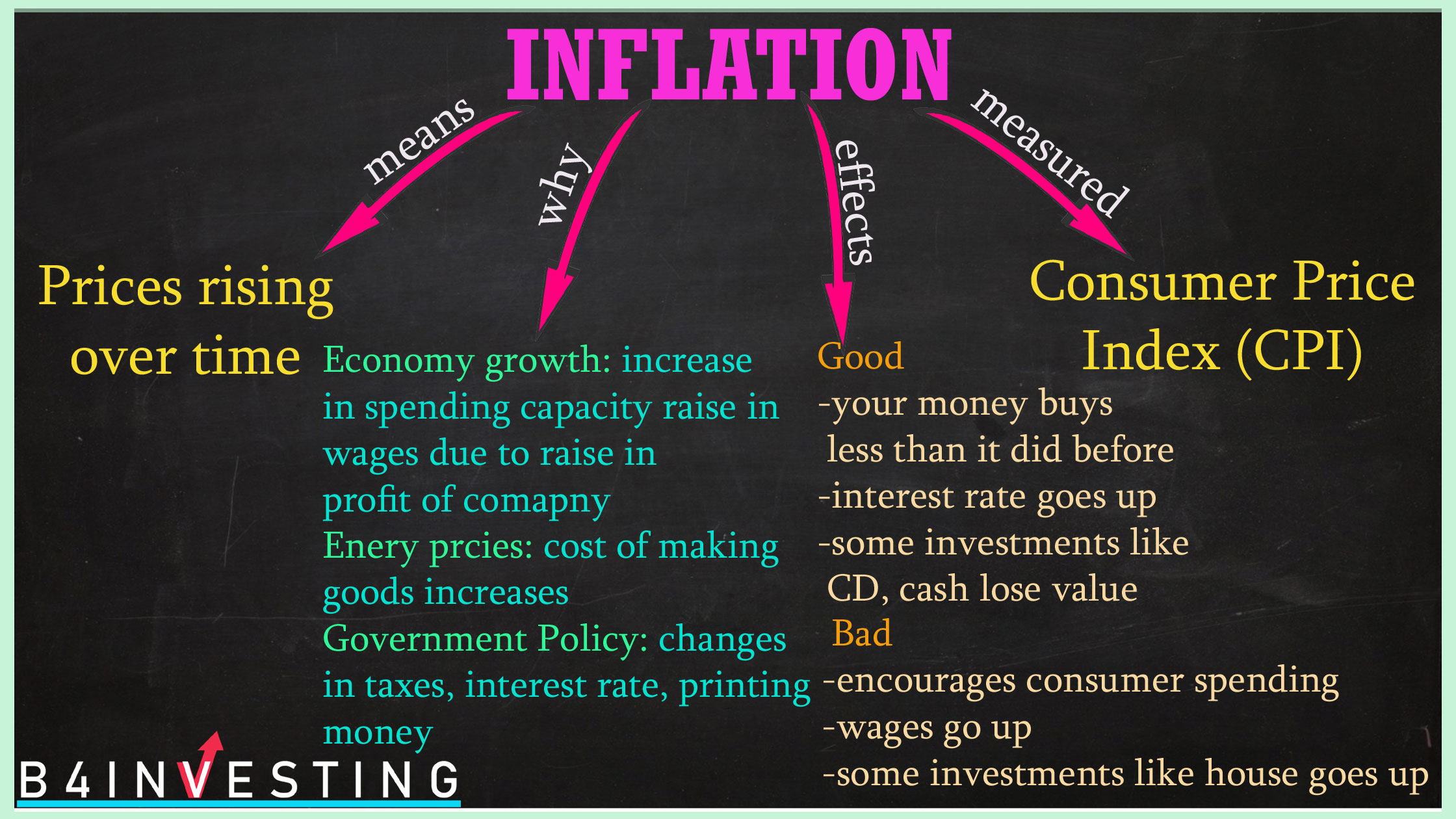

We come across word “inflation” many times. When people say “Inflation is rising“, does everyone understand how and why inflation rises? Today we will read definition of inflation, types of inflation, what are the main causes, how it is measured.

What is inflation?

Every person needs wide variety of goods and services like food, transport, electricity, fuel, clothes and many more to live day to day comfortable life. When I was in college, I remember I used to pay Rs100 at petrol pump and tank of my two wheeler used to get filled almost full. But today when I give Rs100 at petrol pump, 1/4th of tank of two wheeler gets filled. This is called inflation.

Inflation means the rise in the prices of goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc. If we bought a bag of goods and services at Rs1000 last year and today it is costing Rs1040 then we say inflation is 4% this year. In short, inflation means change in price of goods and services.

How does inflation work?

When I say cost of tetra pack of fruit juice has increased, the cause of rise in price can be increase in price of fruits or increase in wages of workers of factory in which juice is manufactured from fresh fruit, higher transportation charges.

Sometimes, price of good changes due to demand and supply. If more people want to buy a particular good then supplier would increase price to earn more profit and some people would pay high price too. Opposite of that, if supply of particular good is more and demand is low then supplier may reduce the price to attract more customers.

Technology can also affect the inflation as advanced technology makes production cost of goods cheaper so the cost of goods reduces.

Many people assume that printing money causes inflation but that can be true but that is not the case always. There are many factors which influence the inflation like money supply, technology, demographic trends, unemployment rate, debt to income ratios, savings rate, actual supply and demand of the goods and services, and more.

Read also: Classification of Banking System in India and how does it work with RBI?

How is inflation measured in India?

There are two indices to calculate inflation.

| Wholesale Price Index (WPI) | Consumer Price Index (CPI) |

| The price of goods and services is calculated for a basket of goods based on prices charged by wholesalers | The price of goods and services is calculated for a basket of goods based on the value paid by a normal consumer |

| WPI is released by Ministry of Commerce | CPI is released by Central Statistical Office |

CPI is better indicator of inflation as it takes into account the tax paid by the customer.

We say price is increased by 6% or inflation is 6% but 6% of what? It means 5% increase in the price of basket of goods and services of base year. In India, the base year is 2012. So, if basket of good was costing Rs100 in year 2012 then today it is Rs106.

What is the inflation rate formula?

Inflation rate formula is the difference between past CPI and current CPI divided by initial CPI. The result then multiplied by 100 gives the inflation rate.

| Rate of Inflation = (Current CPI – Past CPI/ Past CPI)*100 *CPI= Consumer Price Index |

Who benefits from inflation?

Inflation affects economy but it doesn’t affect everyone a bad way. Customers lose purchasing power but investor gain from it. Investors who invest in assets which get affected by inflation can give good returns if kept for long term. Increase in the price of house may affect a customer who wants to buy a new house but it benefits a customer who has already bought it from capital appreciation.

What are the effects of inflation? Good or Bad?

Economy gets affected due to inflation in many ways. If price of nation’s currency drops due to inflation, it benefits exporters as their profit is measured in exchange of foreign currency. But, this can not be beneficial for importers as they have to pay more to buy foreign made good.

If income of earning member in the family does not increase as much as prices of goods then purchasing power of family reduces. If income rises as much as prices, a family can maintain their cost of living. Prices change at different speed. For example, the prices of traded commodity change everyday but the wages of people don’t change everyday or every month.

If we think from fixed interest point of view, it affects purchasing power of receivers and payers of fixed interest rate. Like, if a pensioner receives fixed 4% of pension and inflation is higher than 4% then purchasing power of pensioner falls. But if borrower is paying 4% interest to lender and if inflation is higher than 4% then borrower’s income may have increased as per inflation and he has to pay 4% interest only. But it affects the income of lender.

High inflation affect nation’s economy deflation is also not favorable condition for economy. Deflation is opposite of inflation. When prices go down, customers delay buying goods in expectation of more lower prices in future. So, this means less economic activity. So, low stable predictable inflation is good for economy.

How do we prevent inflation?

Adjusting the interest rates to change the monitory policy is primary strategy to prevent inflation. Higher interest rates decrease the demand in the economy. This results in lower economic growth and therefore, lower inflation.

Controlling the money supply can also help in preventing inflation.

Higher Income Tax rate can reduce the purchasing. So it reduces demand and inflationary pressures.

Policies to increase the efficiency and competitiveness of the economy helps in reducing the long term costs.

Read also: Gold Investment: Pros and Cons of Investing in Gold

FAQ

Can gold beat inflation?

Gold is often considered as a hedge against inflation. It means the yellow metal will be able to beat inflation over the long term. Gold is also known as a safe-haven asset, as it performs well when other assets such as equities generate negative returns.